California Earned Income Tax Credit Worksheet Part Iii Line 6

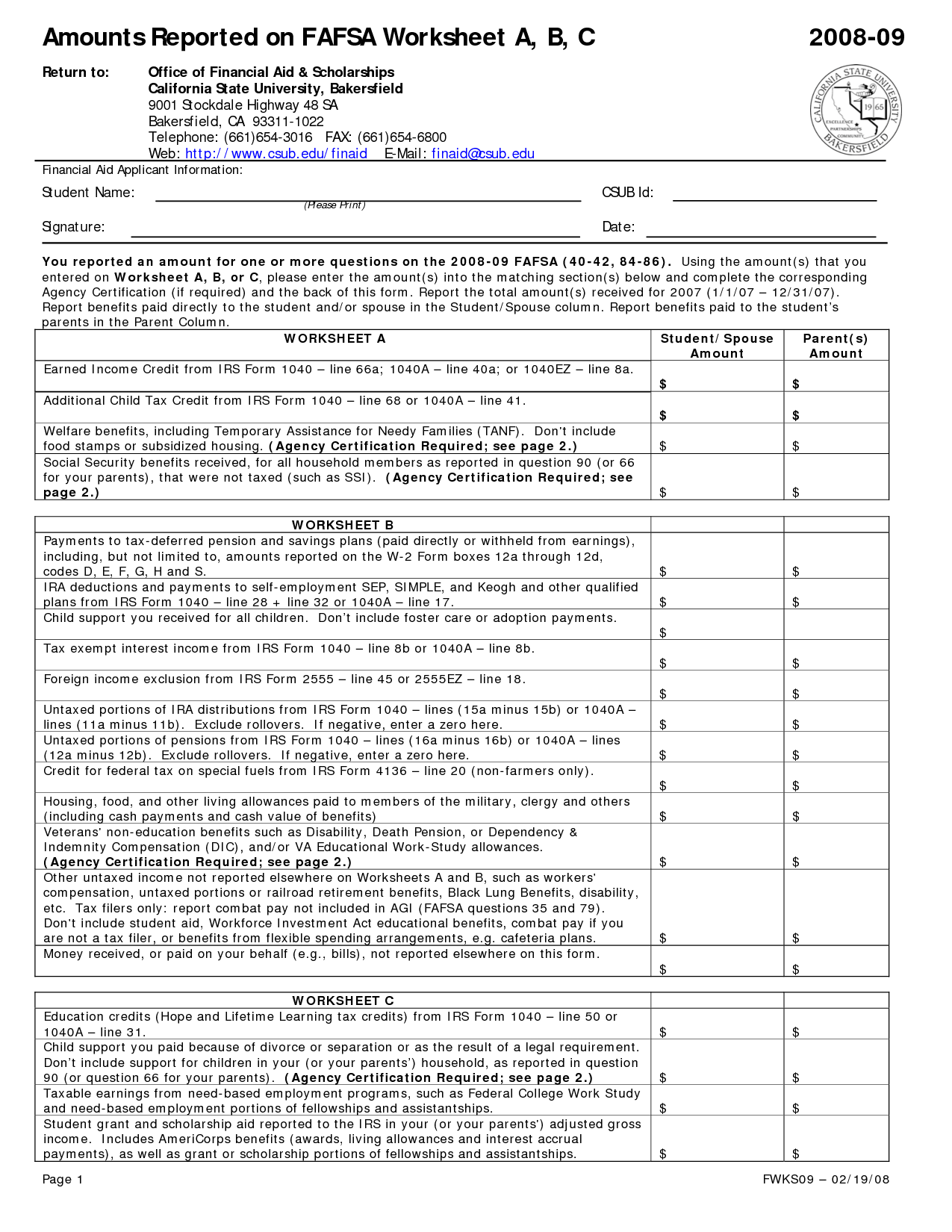

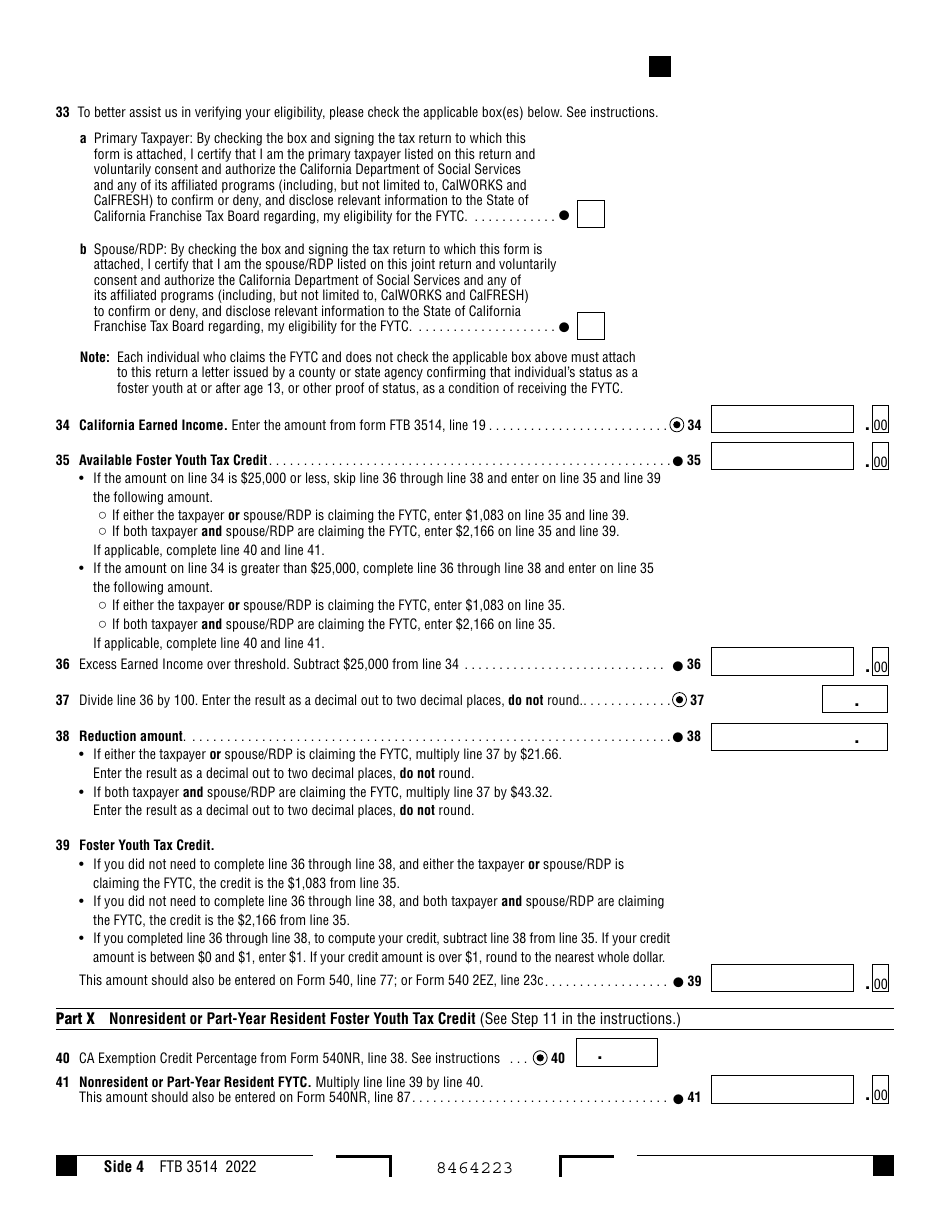

California Earned Income Tax Credit Worksheet Part Iii Line 6 - If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Enter your california earned income from form ftb 3514, line 19. Enter your california earned income from form ftb 3514, line 19. Be sure to check both state and federal eligibility requirements. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Claiming your eitc is easy. Just file your state and/ or federal tax returns. If the amount is zero or less, stop here. You must fill out your child/children's qualifying information along with your earned income to obtain the. Complete the california earned income tax credit worksheet below.

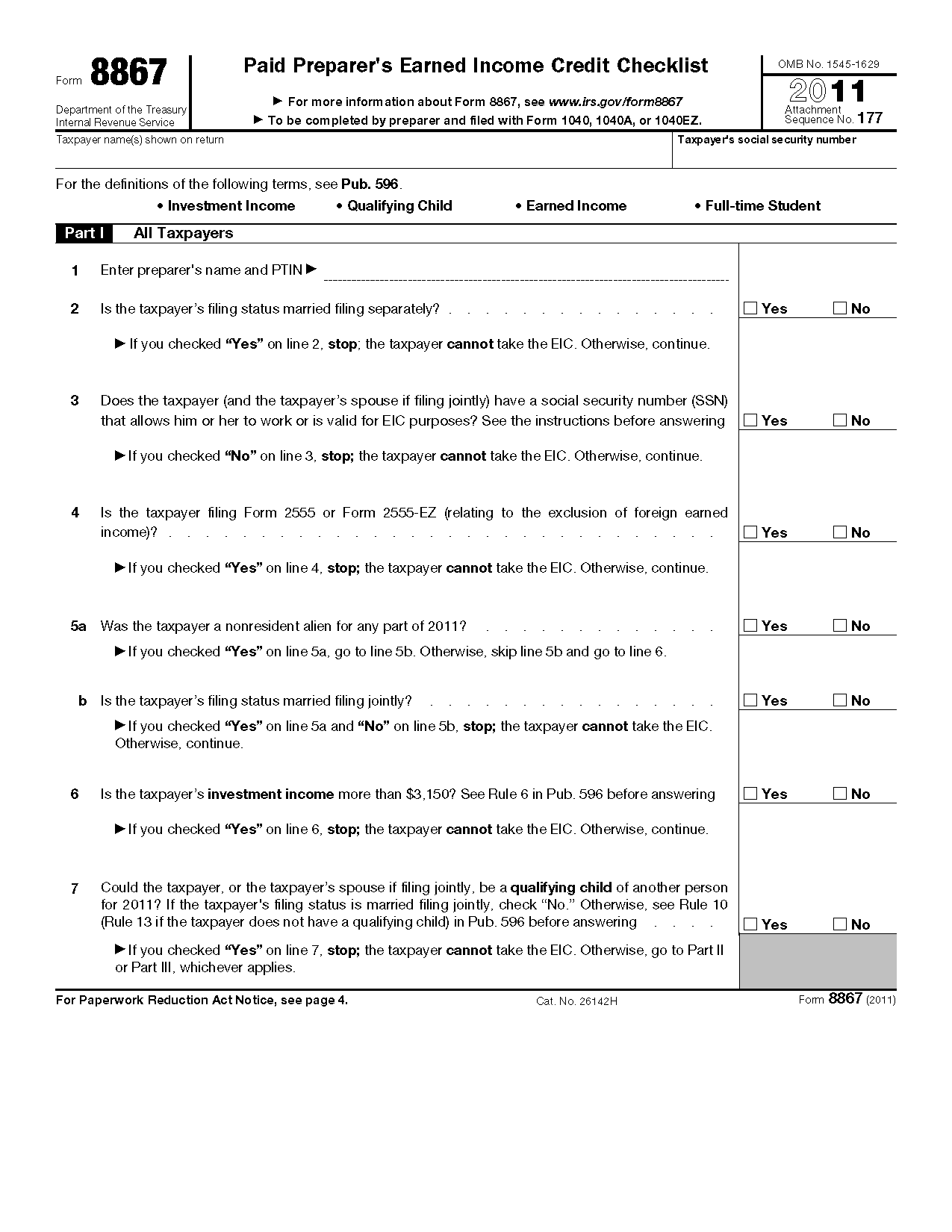

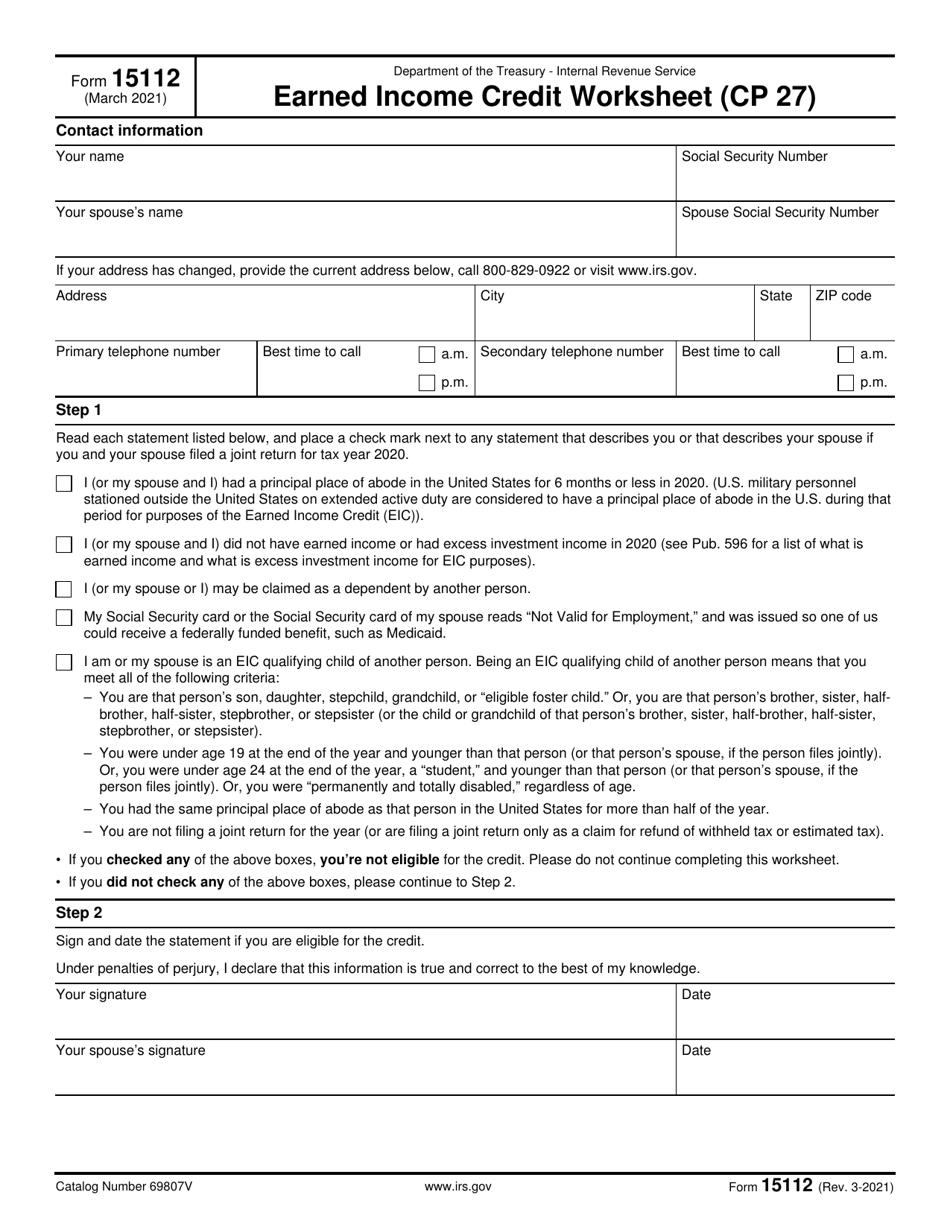

If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. You must fill out your child/children's qualifying information along with your earned income to obtain the. Enter your california earned income from form ftb 3514, line 19. If the amount is zero or less, stop here. Claiming your eitc is easy. Enter your california earned income from form ftb 3514, line 19. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Just file your state and/ or federal tax returns. Look up the amount on line. Tax form for earned income tax credits.

Enter your california earned income from form ftb 3514, line 19. Tax form for earned income tax credits. Be sure to check both state and federal eligibility requirements. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Claiming your eitc is easy. Look up the amount on line. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Complete the california earned income tax credit worksheet below. You must fill out your child/children's qualifying information along with your earned income to obtain the. Just file your state and/ or federal tax returns.

Ca Earned Tax Credit Worksheet 2022

Look up the amount on line. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Enter your california earned income from form ftb 3514, line 19. Tax form for earned income tax credits. You must fill out your child/children's qualifying information along with your earned income to obtain the.

Ca Earned Tax Credit Worksheet 2020

You must fill out your child/children's qualifying information along with your earned income to obtain the. Be sure to check both state and federal eligibility requirements. Claiming your eitc is easy. Look up the amount on line. Just file your state and/ or federal tax returns.

California Earned Tax Credit Worksheet

If the amount is zero or less, stop here. Claiming your eitc is easy. Complete the california earned income tax credit worksheet below. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Enter your california earned income from form ftb 3514, line 19.

California Earned Tax Credit Worksheet Printable Calendars AT

Tax form for earned income tax credits. Enter your california earned income from form ftb 3514, line 19. Look up the amount on line. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. If the amount is zero or less, stop here.

Earned Worksheet 2022 Worksheet Irs 1040 Form Tax Cre

You must fill out your child/children's qualifying information along with your earned income to obtain the. Complete the california earned income tax credit worksheet below. If the amount is zero or less, stop here. Be sure to check both state and federal eligibility requirements. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6.

Form FTB3514 Download Fillable PDF or Fill Online California Earned

Look up the amount on line. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. If the amount is zero or less, stop here. Enter your california earned income from form ftb 3514, line 19. Tax form for earned income tax credits.

Earned Tax Credit Worksheet 2023

Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Look up the amount on line. Claiming your eitc is easy. Complete the california earned income tax credit worksheet below. Enter your california earned income from form ftb 3514, line 19.

Earned Credit Worksheet Cp 27

If the amount is zero or less, stop here. Tax form for earned income tax credits. Enter your california earned income from form ftb 3514, line 19. Just file your state and/ or federal tax returns. Enter your california earned income from form ftb 3514, line 19.

Ca Earned Tax Credit Worksheet 2020

Just file your state and/ or federal tax returns. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Tax form for earned income tax credits. Complete the california earned income tax credit worksheet below. If the amount is zero or less, stop here.

California Earned Tax Credit Worksheet 2015 Worksheet Resume

Look up the amount on line. You must fill out your child/children's qualifying information along with your earned income to obtain the. Enter your california earned income from form ftb 3514, line 19. Enter your california earned income from form ftb 3514, line 19. Just file your state and/ or federal tax returns.

Enter Your California Earned Income From Form Ftb 3514, Line 19.

Tax form for earned income tax credits. If you file form 540 or 540 2ez, after completing step 6, skip step 7 and go to. Complete the california earned income tax credit worksheet below. Look up the amount on line.

Claiming Your Eitc Is Easy.

Just file your state and/ or federal tax returns. Compare the amounts on line 5 and line 2, enter the smaller amount on line 6. Enter your california earned income from form ftb 3514, line 19. You must fill out your child/children's qualifying information along with your earned income to obtain the.

If The Amount Is Zero Or Less, Stop Here.

Be sure to check both state and federal eligibility requirements.