Discounted Cash Flow Model Excel Template

Discounted Cash Flow Model Excel Template - Web january 31, 2022. Where, cf = cash flow in year. How to build a dcf model: Which cash flow is used in dcf? It determines the decision to buy or sell a company in the business sector. The big idea behind a dcf model 5:21: Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Click here to download the dcf template.

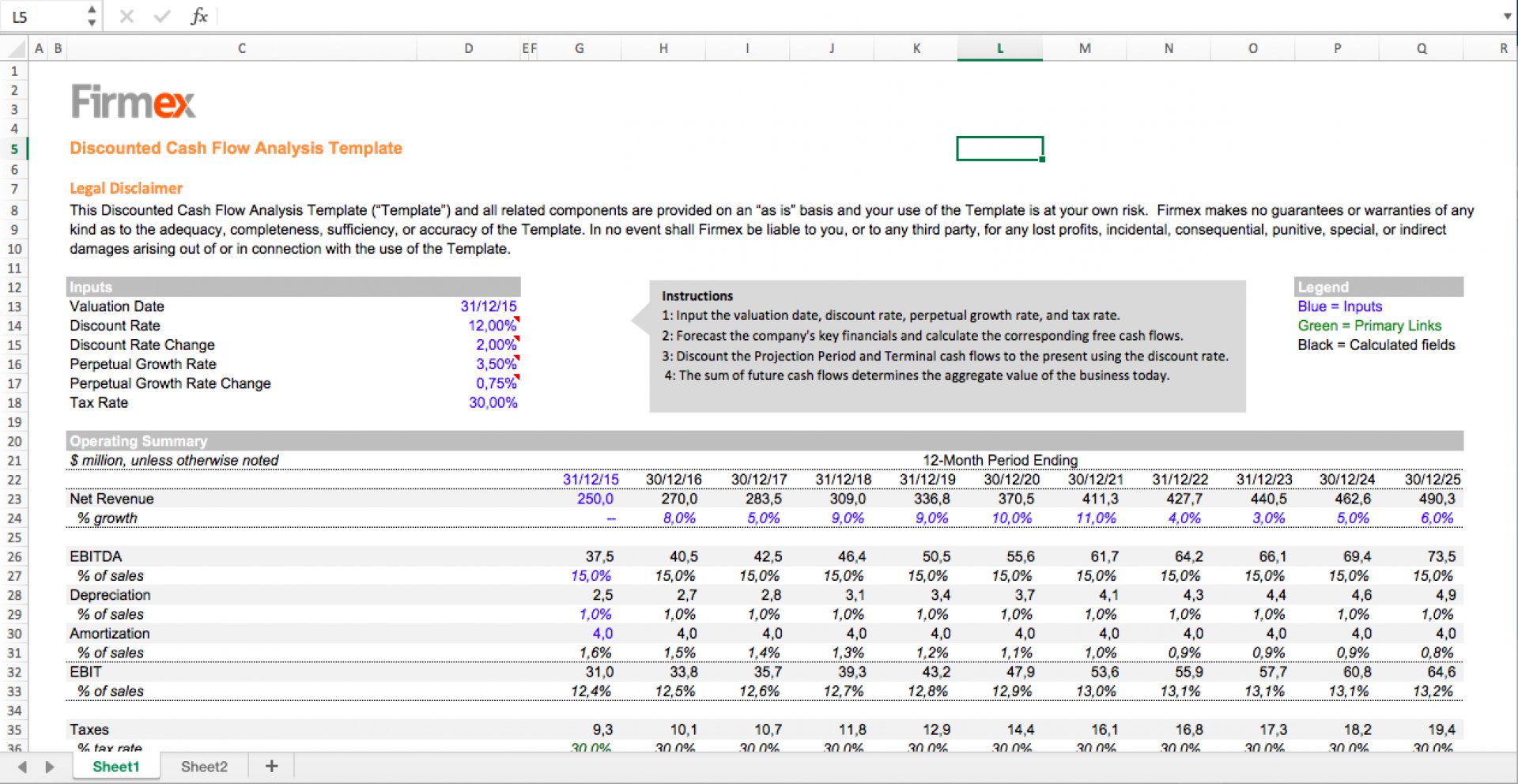

Enter your name and email in the form below and download the free template now! Web discounted cash flow template. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web january 31, 2022. Below is a preview of the dcf model template: The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Click here to download the dcf template. Cf = cash flow in the period r = the interest rate or discount rate n = the period number analyzing the components of the. Which cash flow is used in dcf? Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of the period number.

Therefore, all future cash flows must be taken into consideration. Enter your name and email in the form below and download the free template now! Where, cf = cash flow in year. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: The term discounted cash flowis a very common one in the field of finance and accounting. It determines the decision to buy or sell a company in the business sector. Unlevered free cash flow 21:46: The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. This template allows you to build your own discounted cash flow model with different assumptions. Here is the dcf formula:

Discounted Cash Flow Excel Model Template Eloquens

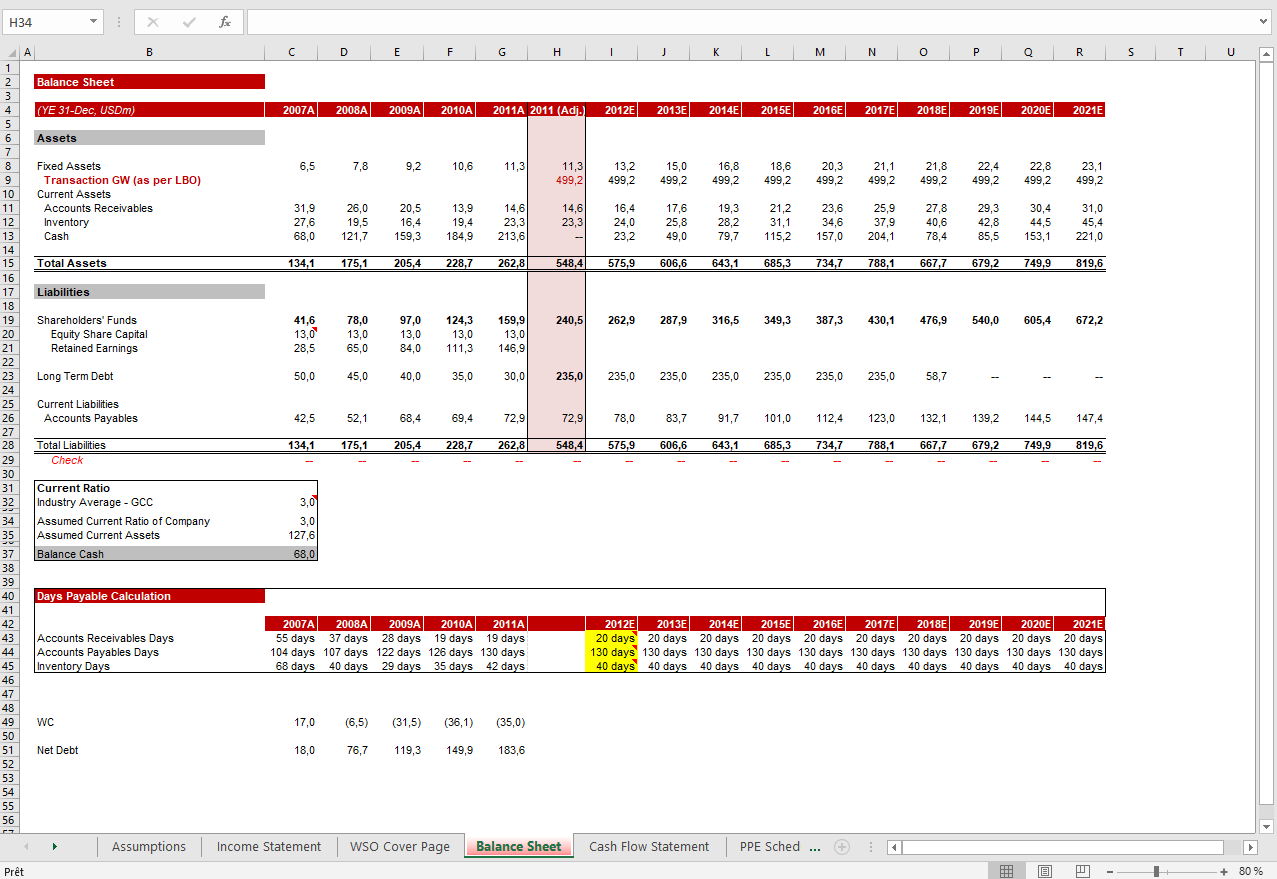

Download wso's free discounted cash flow (dcf) model template below! Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. How to build a dcf model: Web the formula for dcf is: Discounted cash flow (dcf) calculates the value of a company based on future cash flows;

Discounted Cash Flow Excel Model Template Eloquens

Which cash flow is used in dcf? Web the formula for dcf is: Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. This template allows you to build your.

DCF Discounted Cash Flow Model Excel Template Eloquens

This template allows you to build your own discounted cash flow model with different assumptions. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future.

DCF, Discounted Cash Flow Valuation in Excel Video YouTube

How to build a dcf model: Download wso's free discounted cash flow (dcf) model template below! Web the formula for dcf is: This template allows you to build your own discounted cash flow model with different assumptions. Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions.

DCF Discounted Cash Flow Model Excel Template Eloquens

Download wso's free discounted cash flow (dcf) model template below! Enter your name and email in the form below and download the free template now! Web discounted cash flow template. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web aug 4, 2022 0 get free advanced excel.

Single Sheet DCF (Discounted Cash Flow) Excel Template FinWiser

How to build a dcf model: Web the formula for dcf is: Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of the period number. Below is a preview of the dcf model template: Enter your name.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Web the formula for dcf is: The term discounted cash flowis a very common one in the field of finance and accounting. Therefore, all future cash flows must be taken into consideration. Web january 31, 2022. Where, cf = cash flow in year.

Cash Flow Excel Template Download from Xlteq

Download wso's free discounted cash flow (dcf) model template below! How to build a dcf model: Web the formula for dcf is: Enter your name and email in the form below and download the free template now! Click here to download the dcf template.

7 Cash Flow Analysis Template Excel Excel Templates

It determines the decision to buy or sell a company in the business sector. Web january 31, 2022. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Cf = cash flow in the period r = the interest rate or discount rate n = the period number analyzing.

Discounted Cash Flow Valuation Excel » The Spreadsheet Page

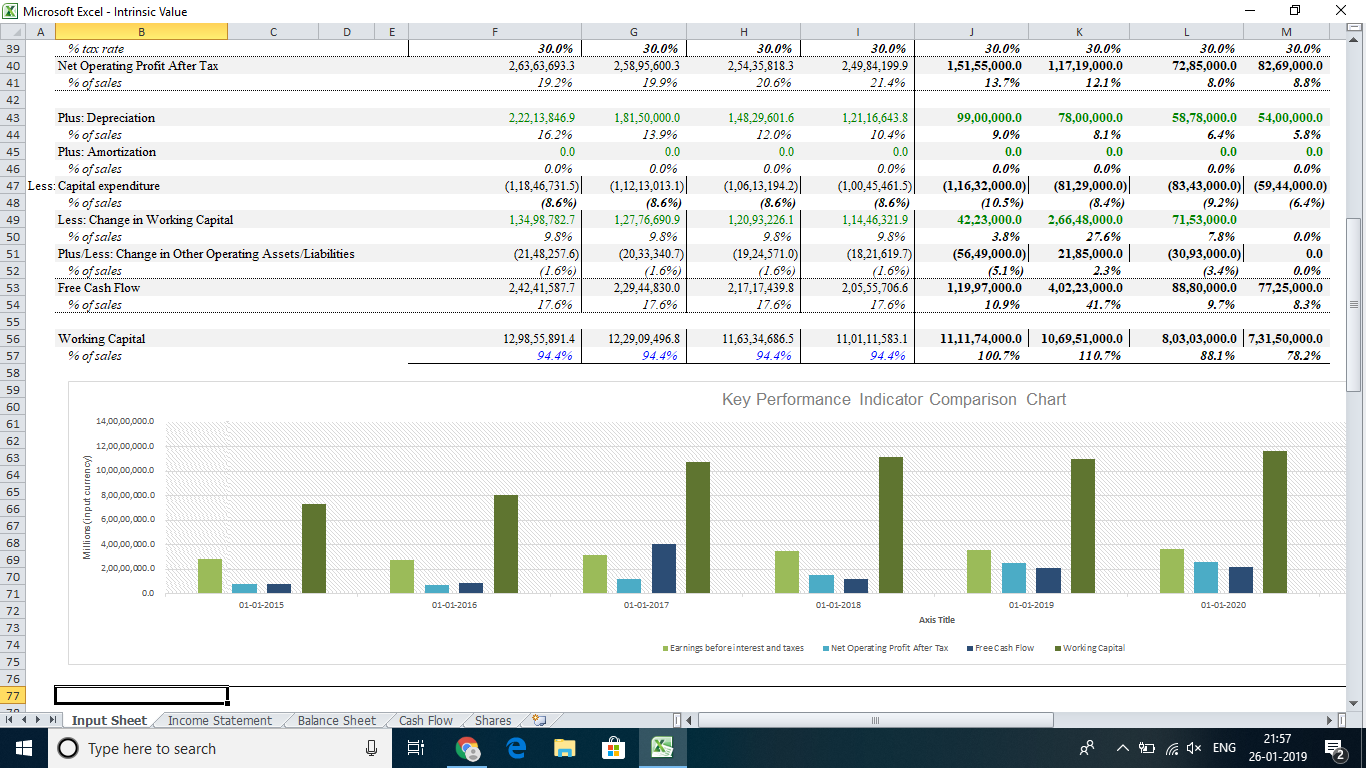

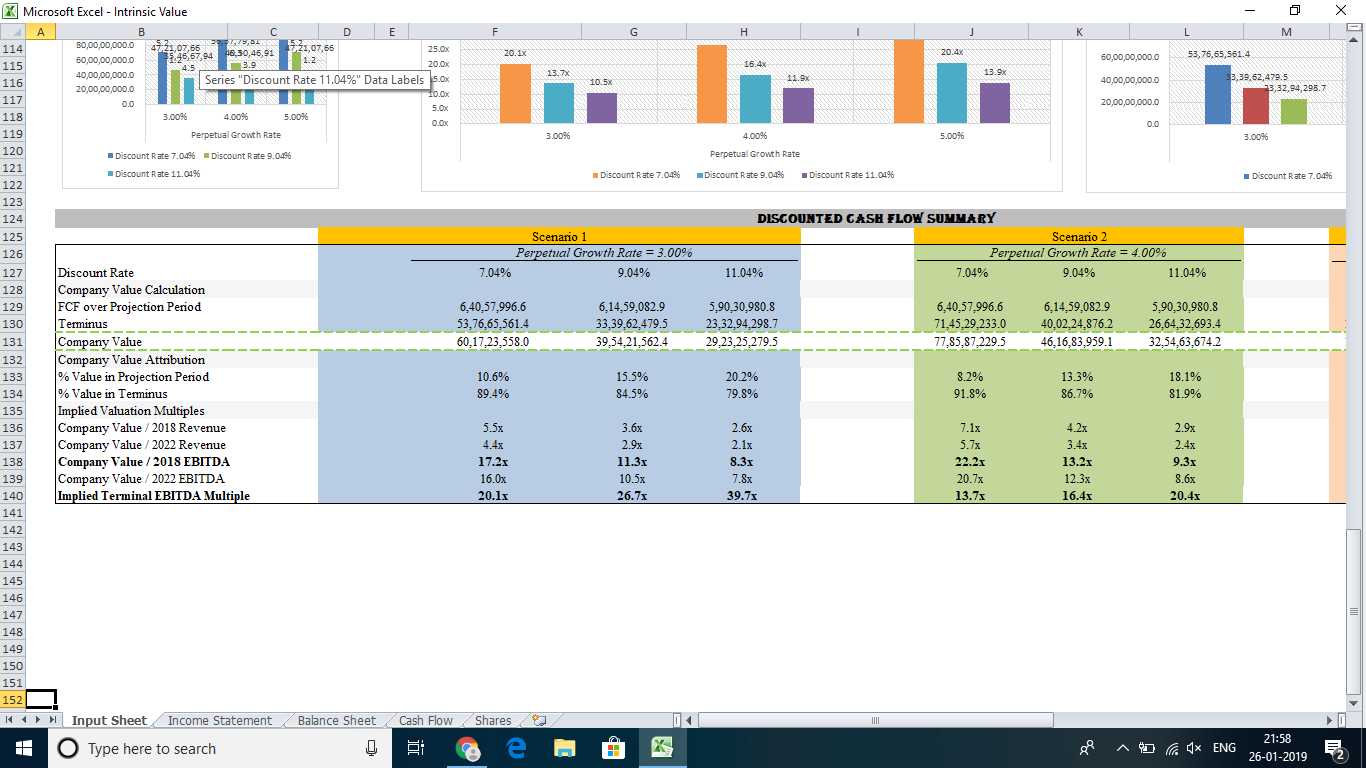

Unlevered free cash flow 21:46: The big idea behind a dcf model 5:21: This discounted cash flow template helps you estimate your company’s intrinsic value versus its market value. It determines the decision to buy or sell a company in the business sector. Web aug 4, 2022 0 get free advanced excel exercises with solutions!

Web This Dcf Model Template Provides You With A Foundation To Build Your Own Discounted Cash Flow Model With Different Assumptions.

Here is the dcf formula: Which cash flow is used in dcf? Web discounted cash flow template. Download wso's free discounted cash flow (dcf) model template below!

The Term Discounted Cash Flowis A Very Common One In The Field Of Finance And Accounting.

Therefore, all future cash flows must be taken into consideration. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Web january 31, 2022. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow.

The Big Idea Behind A Dcf Model 5:21:

Enter your name and email in the form below and download the free template now! Where, cf = cash flow in year. Web the formula for dcf is: Discounted cash flow (dcf) calculates the value of a company based on future cash flows;

Below Is A Preview Of The Dcf Model Template:

Web aug 4, 2022 0 get free advanced excel exercises with solutions! This discounted cash flow template helps you estimate your company’s intrinsic value versus its market value. Click here to download the dcf template. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of the period number.