Employer Stock Worksheet Line 25 Column B

Employer Stock Worksheet Line 25 Column B - This article will help you decide. For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the. When i did smart check, i got an message of employer stock worksheet:

There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the. For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. When i did smart check, i got an message of employer stock worksheet: This article will help you decide.

When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the. There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. When i did smart check, i got an message of employer stock worksheet: This article will help you decide.

Blank 10 Column Worksheet Template

When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the. There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. This article will help you decide. For special situations such as multiple purchase lots and.

Employer Stock Worksheet Line 25 Column B

When i did smart check, i got an message of employer stock worksheet: For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. This article will help you decide. When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it.

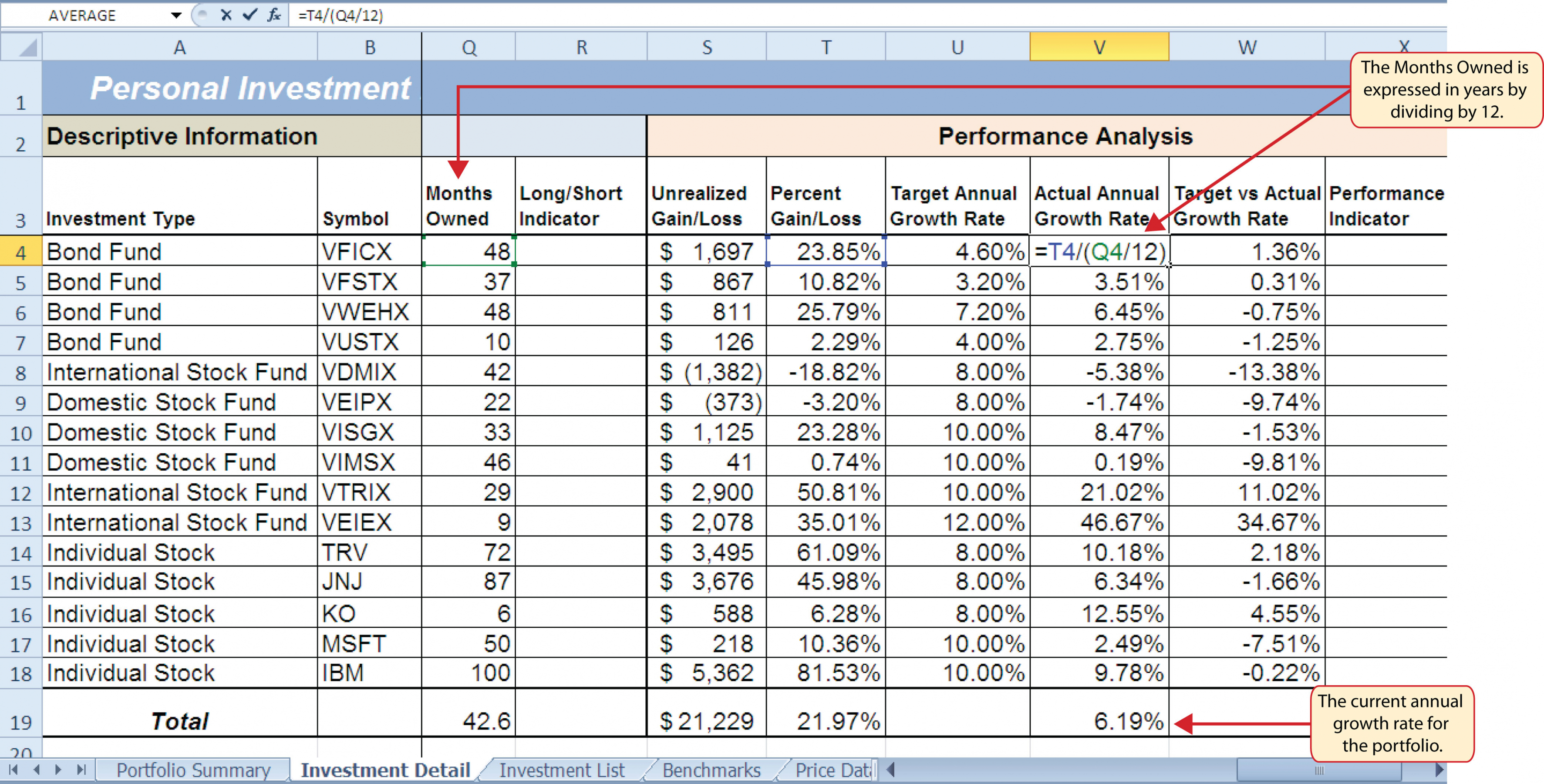

Stock Analysis Spreadsheet in Stock Analysis Spreadsheet Concept Of

This article will help you decide. When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the. For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. When i did smart check,.

Columnar Worksheet Printable, 2 Columns Worksheets, Printables, Column

When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the. When i did smart check, i got an message of employer stock worksheet: For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be.

Free Printable Charts With 4 Columns

For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. This article will help you decide. When i did smart check, i got an message of employer stock.

Stock Option Plan Template

For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the. This article will help you decide. There are five primary ways.

Stock Control Excel Spreadsheet Template Spreadsheet Downloa stock

This article will help you decide. For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. When i opened the forms section in turbotax to see exactly what.

Stock Portfolio Tracking Spreadsheet in Freetfolio Tracking Spreadsheet

There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. This article will help you decide. When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the. When i did smart check, i got an message.

Stock Analysis Spreadsheet for U.S. Stocks Free Download Worksheets

When i did smart check, i got an message of employer stock worksheet: For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. When i opened the forms.

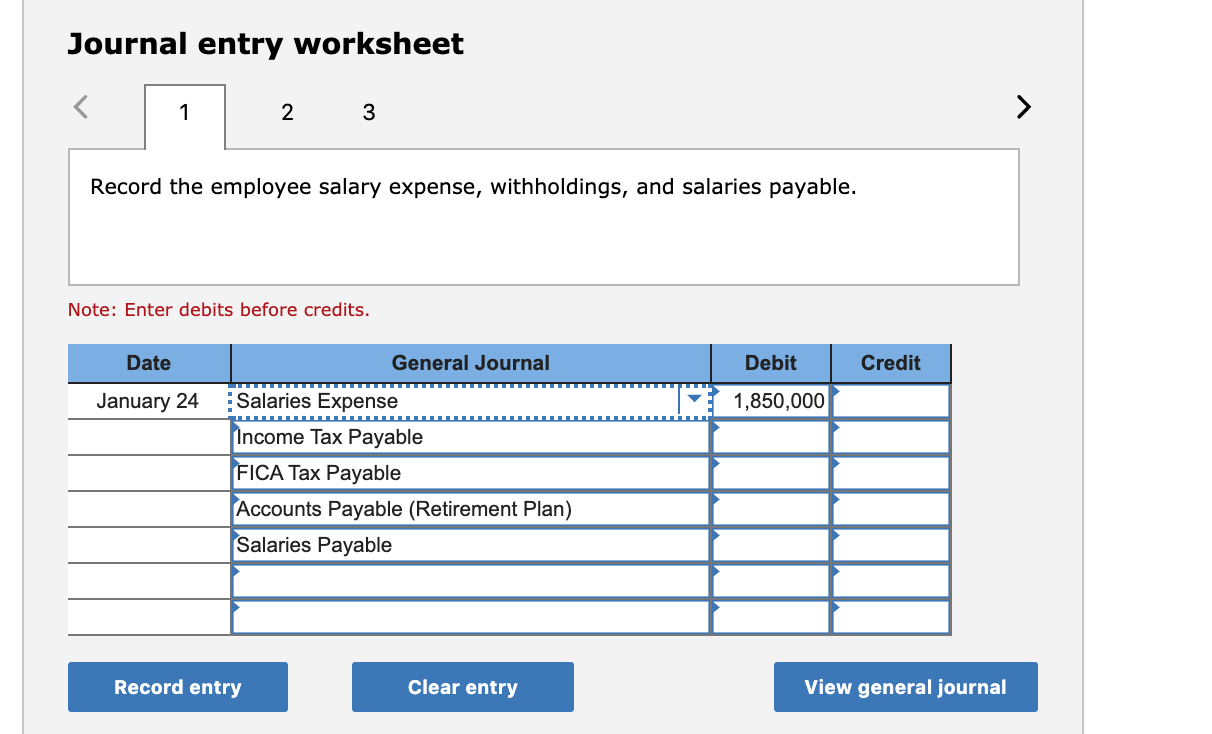

Employee Worksheet Worksheets Library

There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it.

This Article Will Help You Decide.

When i did smart check, i got an message of employer stock worksheet: For special situations such as multiple purchase lots and sales of employer stock, the capital gain (loss) transaction worksheet may be used to. There are five primary ways of entering stock and other capital gain and loss transactions on the schedule d. When i opened the forms section in turbotax to see exactly what line 25 column (b) was, it made me think i should be entering the.