Irs Wisp Template Download

Irs Wisp Template Download - Sign it in a few clicks. Creating a written information security plan (wisp) for your tax & accounting practice 2. You will need to use an editor such as microsoft word or equivalent to open and edit the file. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Sample template 5 written information security plan (wisp) 5. Federal law requires all professional tax preparers to create and implement a data security plan. Edit your wisp template online. The sample plan is available on irs.gov. Web click the data security plan template link to download it to your computer. The amendments are applicable beginning june 9, 2023.

Edit your wisp template online. Sign it in a few clicks. You will need to use an editor such as microsoft word or equivalent to open and edit the file. Web click the data security plan template link to download it to your computer. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. The sample plan is available on irs.gov. The irs also has a wisp template in publication 5708. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Federal law requires all professional tax preparers to create and implement a data security plan. Complete the items in red and fill in the tables as needed.

Creating a written information security plan (wisp) for your tax & accounting practice 2. Sign it in a few clicks. The sample plan is available on irs.gov. Edit your wisp template online. Developing a wisp a good wisp should identify the risks of data loss for the types of information handled by a company and focus on three areas: Web you can also download it, export it or print it out. Added detail for consideration when creating your wisp 13. Complete the items in red and fill in the tables as needed. Web click the data security plan template link to download it to your computer. You will need to use an editor such as microsoft word or equivalent to open and edit the file.

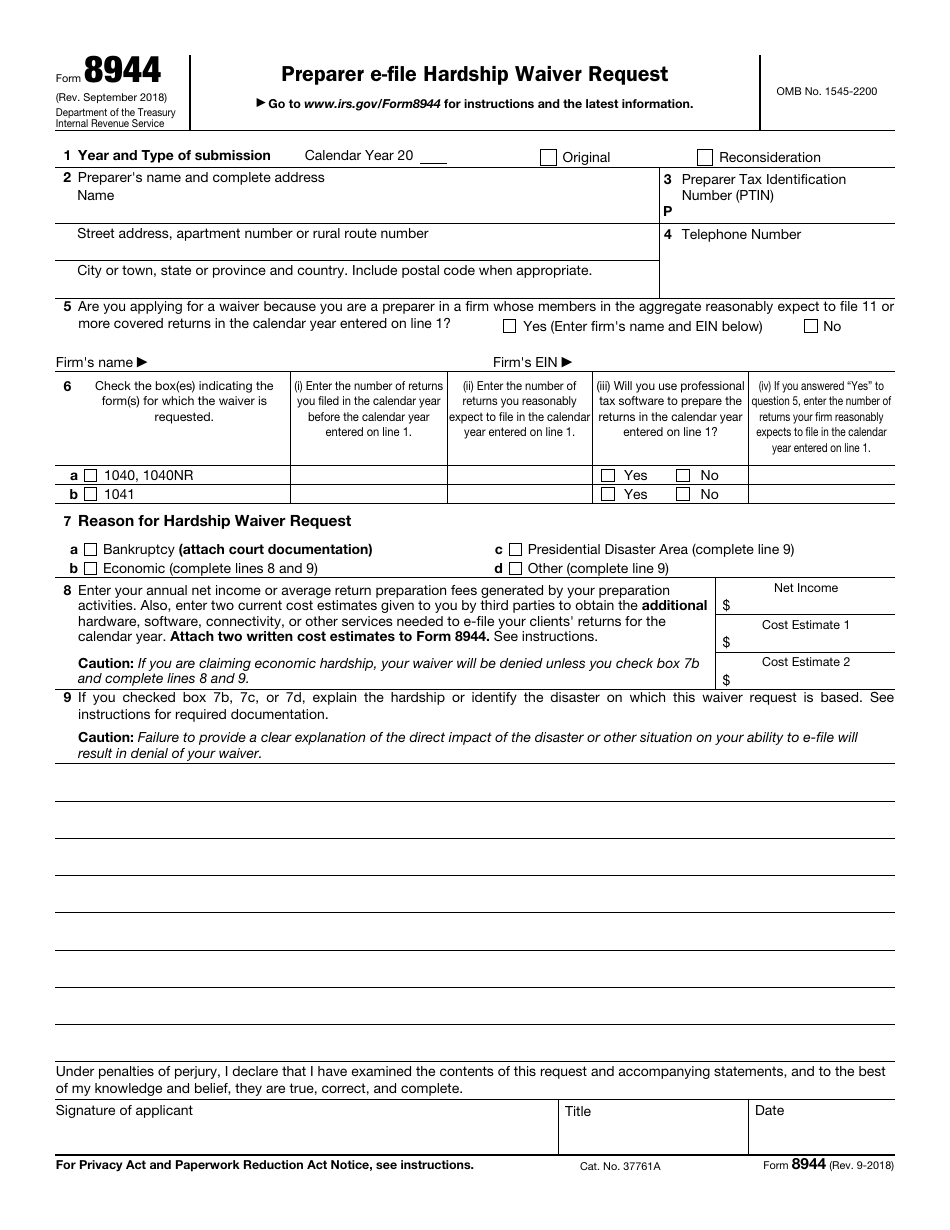

IRS Form 8944 Download Fillable PDF or Fill Online Preparer EFile

Law that requires financial institutions to protect customer data. Developing a wisp a good wisp should identify the risks of data loss for the types of information handled by a company and focus on three areas: The irs also has a wisp template in publication 5708. Web you can also download it, export it or print it out. A security.

The best Office 365 Features for Businesses Tech 4 Accountants

Web you can also download it, export it or print it out. Developing a wisp a good wisp should identify the risks of data loss for the types of information handled by a company and focus on three areas: Web click the data security plan template link to download it to your computer. Web modified nov 4, 2022. You will.

Irs Name Change Letter Sample business name change letter template

Sample template 5 written information security plan (wisp) 5. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web you can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Complete the items in red and fill in.

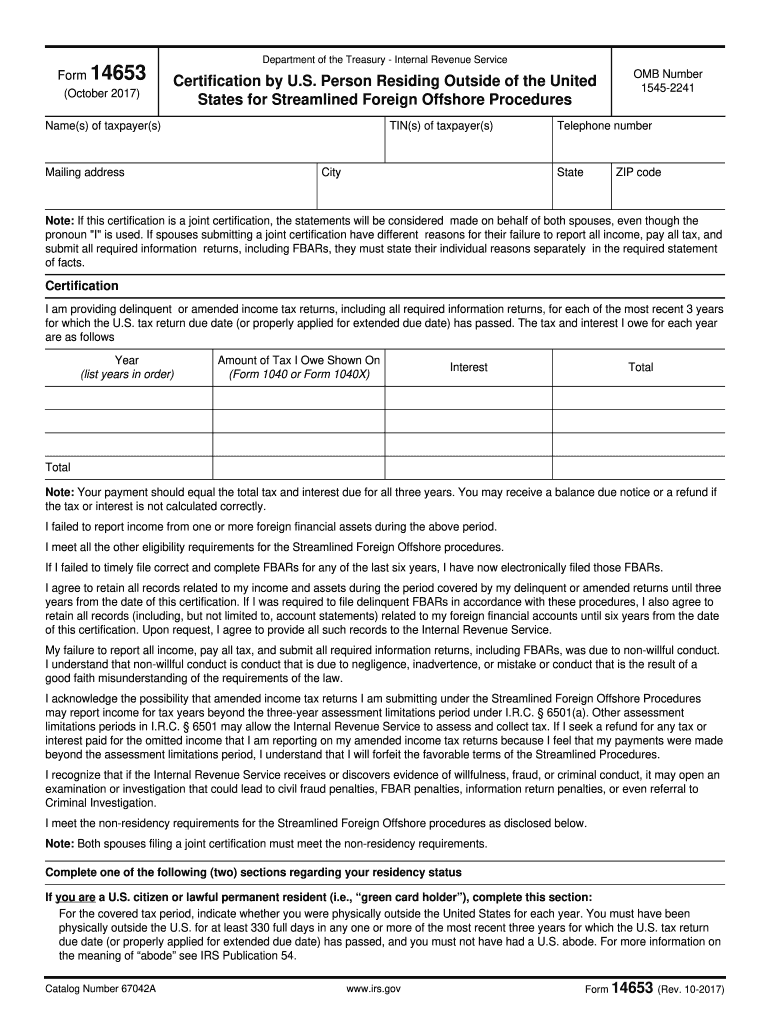

Form 14653 Fill Out and Sign Printable PDF Template signNow

Sign it in a few clicks. Web modified nov 4, 2022. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer data it handles. Web download your free written information security plan template name * first last email * download wisp template as of august 8, 2022 “there’s no way.

211 IRS FORM Whistleblower TEMPLATE.pdf Internal Revenue

Web modified nov 4, 2022. Edit your wisp template online. Developing a wisp a good wisp should identify the risks of data loss for the types of information handled by a company and focus on three areas: Web you can also download it, export it or print it out. A security plan should be appropriate to the company’s size, scope.

IRS Releases New Tax Brackets For 2021 That Will Be Used To

Edit your wisp template online. Web click the data security plan template link to download it to your computer. Added detail for consideration when creating your wisp 13. Type text, add images, blackout confidential details, add comments, highlights and more. The sample plan is available on irs.gov.

Written Information Security Program (WISP) Security Waypoint

Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Type text, add images, blackout confidential details, add comments, highlights and more. The irs also has a wisp template in publication 5708. Web a wisp is a written information security plan that is required for certain businesses,.

WISP Application Form Student Loan Irs Tax Forms

Added detail for consideration when creating your wisp 13. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Law that requires financial institutions to protect customer data. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Creating a written information security plan.

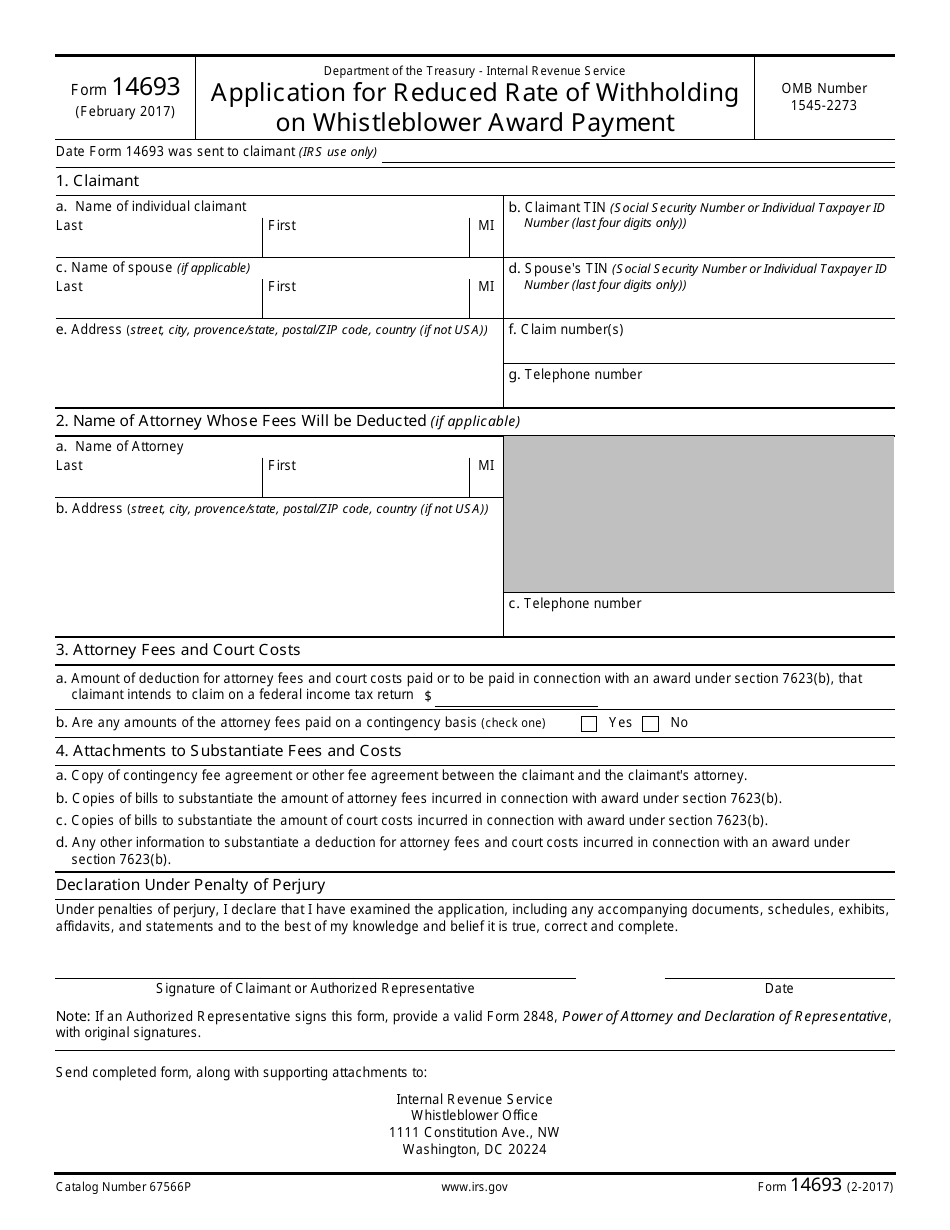

IRS Form 14693 Download Fillable PDF or Fill Online Application for

Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Federal law requires all professional tax preparers to create and implement a data security plan. Sign it in a few clicks. Complete the items in red and fill in the tables as needed. Web click the data security plan template link.

Why your accounting firm should be in the cloud Tech 4 Accountants

Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: You will need to use an editor such as microsoft word or equivalent to open and edit the file. The sample plan is available on irs.gov. Federal law requires all professional tax preparers to create and implement.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Draw your signature, type it, upload its image, or use your mobile device as a signature pad. The irs also has a wisp template in publication 5708. Sample template 5 written information security plan (wisp) 5. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals.

You Will Need To Use An Editor Such As Microsoft Word Or Equivalent To Open And Edit The File.

Web you can also download it, export it or print it out. The security summit partners recently unveiled a special new sample security plan designed to help tax professionals, especially those with smaller practices, protect their data and information. Creating a written information security plan (wisp) for your tax & accounting practice 2. Web click the data security plan template link to download it to your computer.

Web Modified Nov 4, 2022.

Edit your wisp template online. Complete the items in red and fill in the tables as needed. The sample plan is available on irs.gov. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer data it handles.

The Amendments Are Applicable Beginning June 9, 2023.

Sign it in a few clicks. Added detail for consideration when creating your wisp 13. Federal law requires all professional tax preparers to create and implement a data security plan. Law that requires financial institutions to protect customer data.