Is Depreciation On Balance Sheet

Is Depreciation On Balance Sheet - Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. It's expressed in both the balance sheet and income statement of a business. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. It accounts for depreciation charged to expense for the. Depreciation also affects your business. On an income statement or balance sheet. For income statements, depreciation is listed as an expense. Web it represents the decrease in the value of an asset over time. Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes.

Web depreciation is typically tracked one of two places: Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. It accounts for depreciation charged to expense for the. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. On an income statement or balance sheet. Web it represents the decrease in the value of an asset over time. Also, fixed assets are recorded on the balance sheet, and since accumulated. Depreciation also affects your business. It's expressed in both the balance sheet and income statement of a business. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the.

Web depreciation is typically tracked one of two places: It accounts for depreciation charged to expense for the. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. Web it represents the decrease in the value of an asset over time. Depreciation also affects your business. Also, fixed assets are recorded on the balance sheet, and since accumulated. It's expressed in both the balance sheet and income statement of a business. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. For income statements, depreciation is listed as an expense. On an income statement or balance sheet.

What Is Accumulated Depreciation / Why Is Accumulated Depreciation A

Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. Depreciation also affects your business..

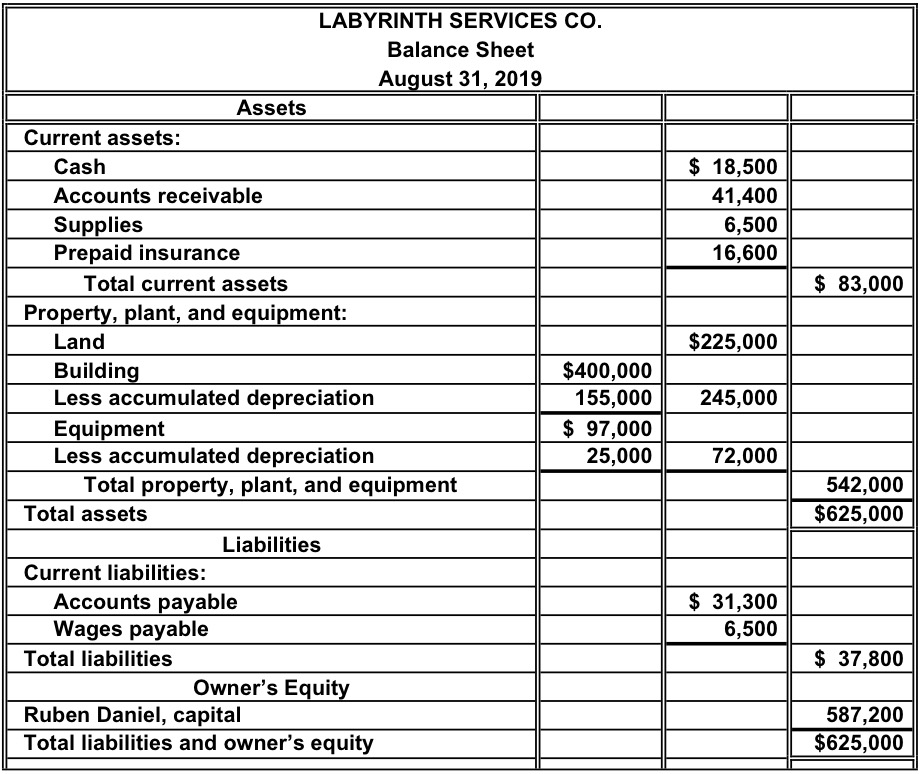

Accounting Questions and Answers EX 413 Balance sheet

Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. It's expressed in both the balance sheet and income statement of a business. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web it.

Depreciation

It accounts for depreciation charged to expense for the. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. On an income statement or balance sheet. Web it represents the decrease in the value of an asset over time. Web depreciation is typically tracked one of two places:

Accumulated Depreciation Balance Sheet / Why do we show an asset at

Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported on the. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web it represents the decrease in the value of an asset over time. Depreciation also affects your business. Web credit.

How To Calculate Depreciation Balance Sheet Haiper

It accounts for depreciation charged to expense for the. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web it represents the decrease in the value of an asset over time. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported.

Balance Sheet Depreciation Understanding Depreciation

It accounts for depreciation charged to expense for the. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Also, fixed assets are recorded on the balance sheet, and since accumulated. On an income statement or balance sheet. Web depreciation is typically tracked one of two places:

template for depreciation worksheet

Depreciation also affects your business. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. Web depreciation is typically tracked one of two places: Web depreciation.

balance sheet Expense Depreciation

Depreciation also affects your business. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of depreciation expense reported.

What is Accumulated Depreciation? Formula + Calculator

Web credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted above, businesses use depreciation for both tax and accounting purposes. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web depreciation expense is reported on the income statement as any other normal business expense, while.

How To Calculate Depreciation Balance Sheet Haiper

Depreciation also affects your business. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web depreciation is typically tracked one of two places: Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web depreciation expense is reported on the income statement as any other normal business expense, while accumulated.

Web Credit To Accumulated Depreciation, Which Is Reported On The Balance Sheet Depreciation And Taxes As Noted Above, Businesses Use Depreciation For Both Tax And Accounting Purposes.

Web it represents the decrease in the value of an asset over time. On an income statement or balance sheet. It's expressed in both the balance sheet and income statement of a business. For income statements, depreciation is listed as an expense.

Also, Fixed Assets Are Recorded On The Balance Sheet, And Since Accumulated.

Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web depreciation is typically tracked one of two places: Depreciation also affects your business. It accounts for depreciation charged to expense for the.