Maryland Pension Exclusion Worksheet

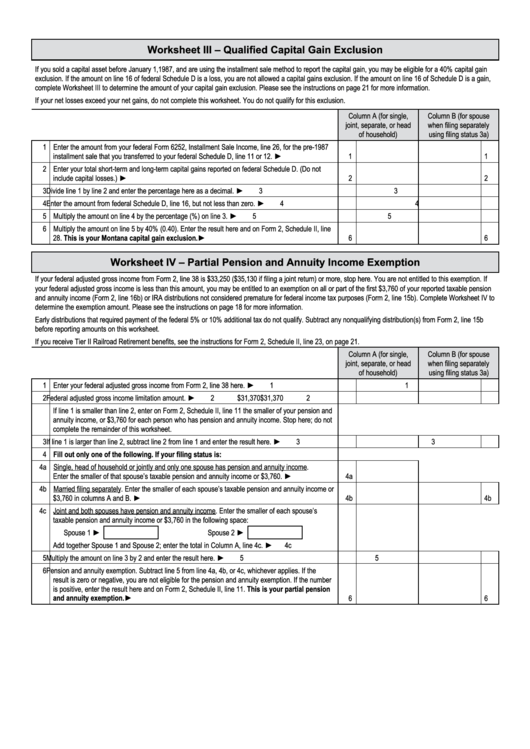

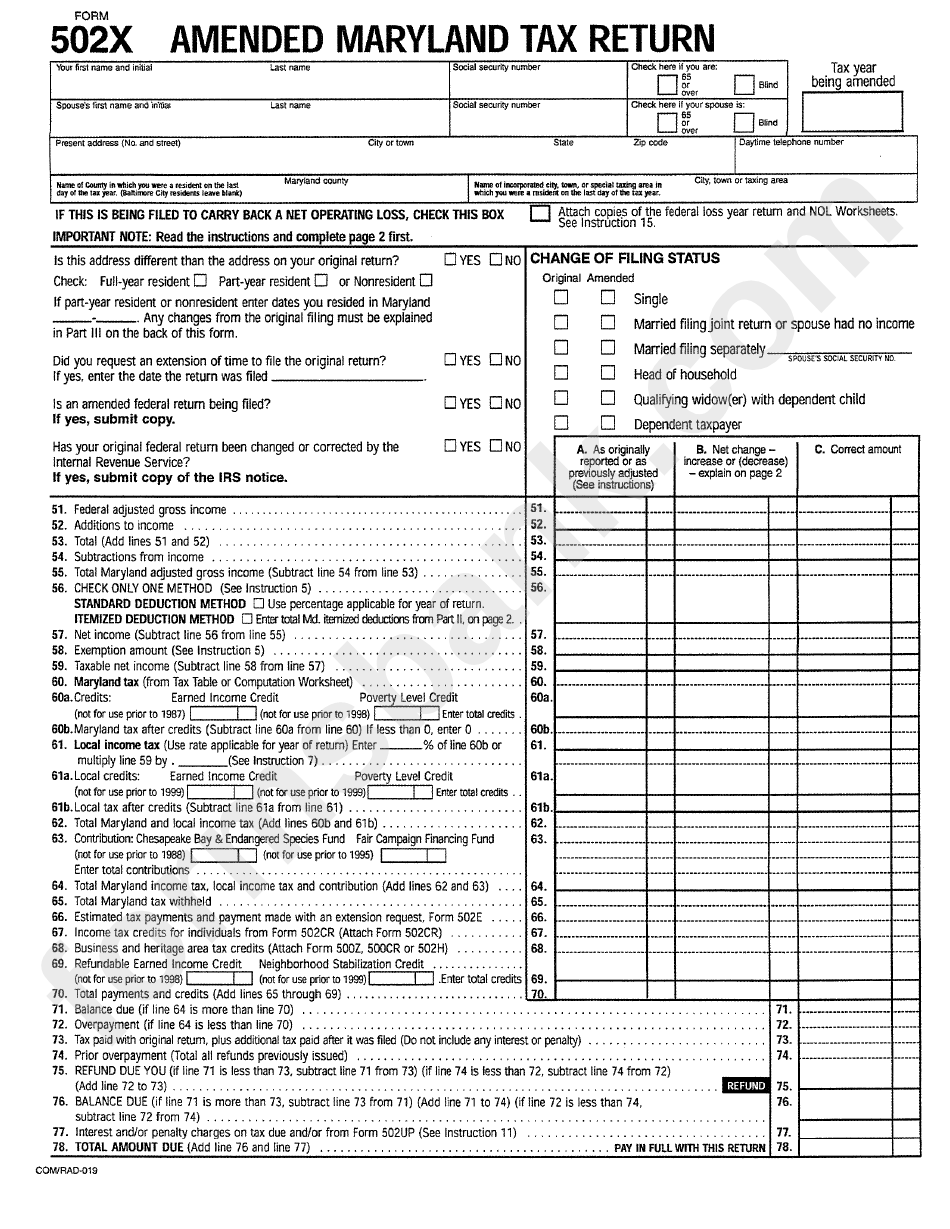

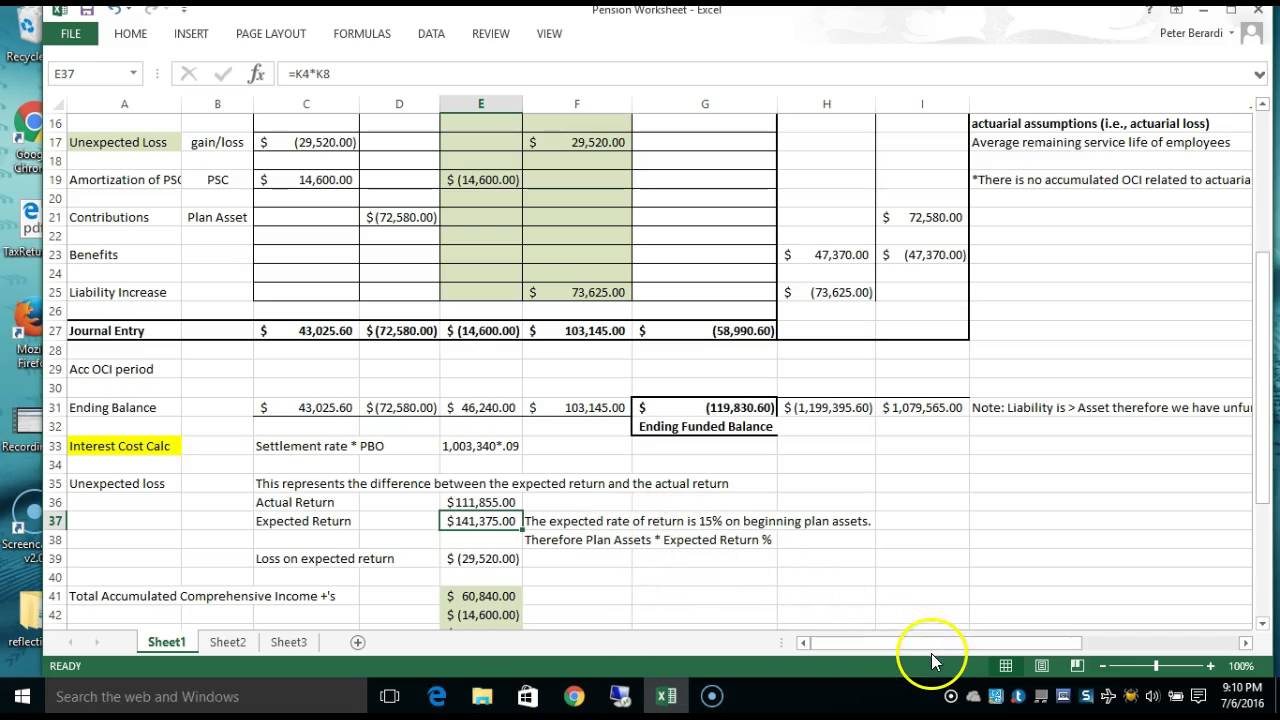

Maryland Pension Exclusion Worksheet - Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. Pension exclusion computation worksheet (13a) specific instructions note: Your social security benefits are not taxed. When both you and your spouse qualify for the pension. If you are filing jointly, make. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have.

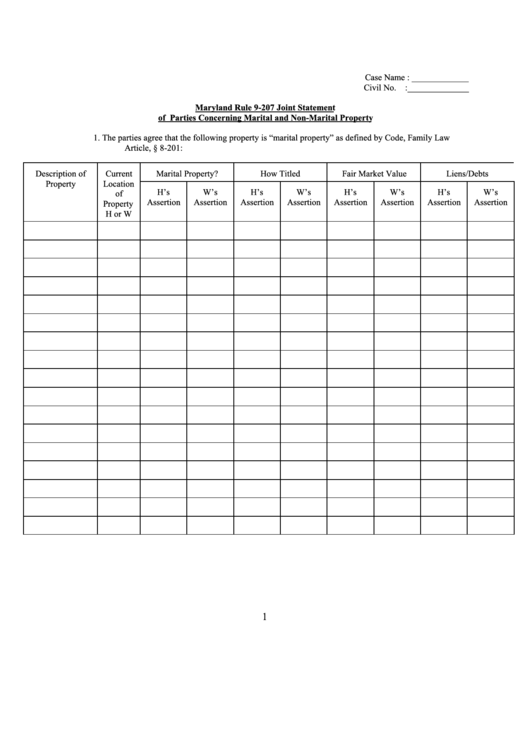

When both you and your spouse qualify for the pension. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. From your $30,000 pension, you can. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. Pension exclusion computation worksheet (13a) specific instructions note: Your social security benefits are not taxed. If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the. If you are filing jointly, make.

If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. When both you and your spouse qualify for the pension. From your $30,000 pension, you can. Pension exclusion computation worksheet (13a) specific instructions note: If you are filing jointly, make. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Your social security benefits are not taxed. Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the.

What Is The Maryland Pension Exclusion

When both you and your spouse qualify for the pension. Your social security benefits are not taxed. From your $30,000 pension, you can. Pension exclusion computation worksheet (13a) specific instructions note: If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have.

Maryland Pension Exclusion 2023 Formula

Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. Your social security benefits are not taxed. From your $30,000 pension, you can. If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. Part 6 if you claimed a pension exclusion on line 10a.

Maryland Pension Exclusion Worksheet Printable And Enjoyable Learning

Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the. If you are 65 or older on the last day of the calendar year, you are totally disabled, or.

Maryland Pension Exclusion 2024

If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. When both you and your spouse qualify for the pension. Part.

Maryland Pension Exclusion 2024 Pdf

If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. If you are filing jointly, make. Your social security benefits are not taxed..

Maryland 2024 Pension Exclusion Amount

Your social security benefits are not taxed. If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. Pension exclusion computation worksheet (13a) specific instructions note: If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. If you are.

Maryland Pension Exclusion 2024 Pdf

If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. From your $30,000 pension, you can. Pension exclusion computation worksheet (13a) specific instructions note: Enter your net taxable.

Maryland Pension Exclusion Worksheet 13a

From your $30,000 pension, you can. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. If you are filing jointly, make. If you are 65 or older on the last day of the.

Md Pension Exclusion Worksheet 13a

If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. When both you and your spouse qualify for the pension. Pension exclusion computation worksheet (13a) specific instructions note: From your $30,000 pension, you can. Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits.

Maryland Pension Exclusion 2024

If you are filing jointly, make. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Your social security benefits are not taxed. If you are 65 or.

If You Are 65 Or Older On The Last Day Of The Calendar Year, You Are Totally Disabled, Or Your Spouse Is Totally Disabled, And You Have.

Your social security benefits are not taxed. Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. When both you and your spouse qualify for the pension.

Part 6 If You Claimed A Pension Exclusion On Line 10A Of Maryland Form 502, Complete Part 6 Using Information From Worksheet 13A Of The.

Pension exclusion computation worksheet (13a) specific instructions note: If you are filing jointly, make. From your $30,000 pension, you can. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your.