Section 263A Calculation Worksheet

Section 263A Calculation Worksheet - Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce. This practice unit outlines the general provisions of sec. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. 263a, including special rules and exceptions for resellers, and provides insight into. This practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under irc 263a. Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a.

The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a. 263a, including special rules and exceptions for resellers, and provides insight into. This practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under irc 263a. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. This practice unit outlines the general provisions of sec. Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce.

Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce. Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. This practice unit outlines the general provisions of sec. This practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under irc 263a. 263a, including special rules and exceptions for resellers, and provides insight into. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a.

Section 263a Calculation Worksheets

Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce. 263a, including special rules and exceptions for resellers, and provides insight into. Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. The additional section 263a costs attach schedule is used to itemize some of.

How To Calculate 263A

The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a. Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce. Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. This practice unit outlines the.

Unicap Calculation Spreadsheet Printable Spreadshee unicap calculation

The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a. Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce..

Federal Register Allocation of Costs Under the Simplified Methods

This practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under irc 263a. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce..

Section 263a Calculation Worksheet prntbl.concejomunicipaldechinu.gov.co

263a, including special rules and exceptions for resellers, and provides insight into. This practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under irc 263a. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. Calculating section 263a costs involves determining and.

Section 263a Calculation Worksheet prntbl.concejomunicipaldechinu.gov.co

The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a. Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. Under irc 263a,.

Section 263a Calculation Worksheet prntbl.concejomunicipaldechinu.gov.co

Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. This practice unit outlines the general provisions of sec. 263a, including special rules and exceptions for resellers, and provides insight.

producer 263a computation

Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a. 263a, including special rules and exceptions for resellers, and provides insight into. This practice unit outlines the general provisions of sec. Under irc 263a,.

Section 263A Calculation Worksheet Printable Word Searches

Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either. 263a, including special.

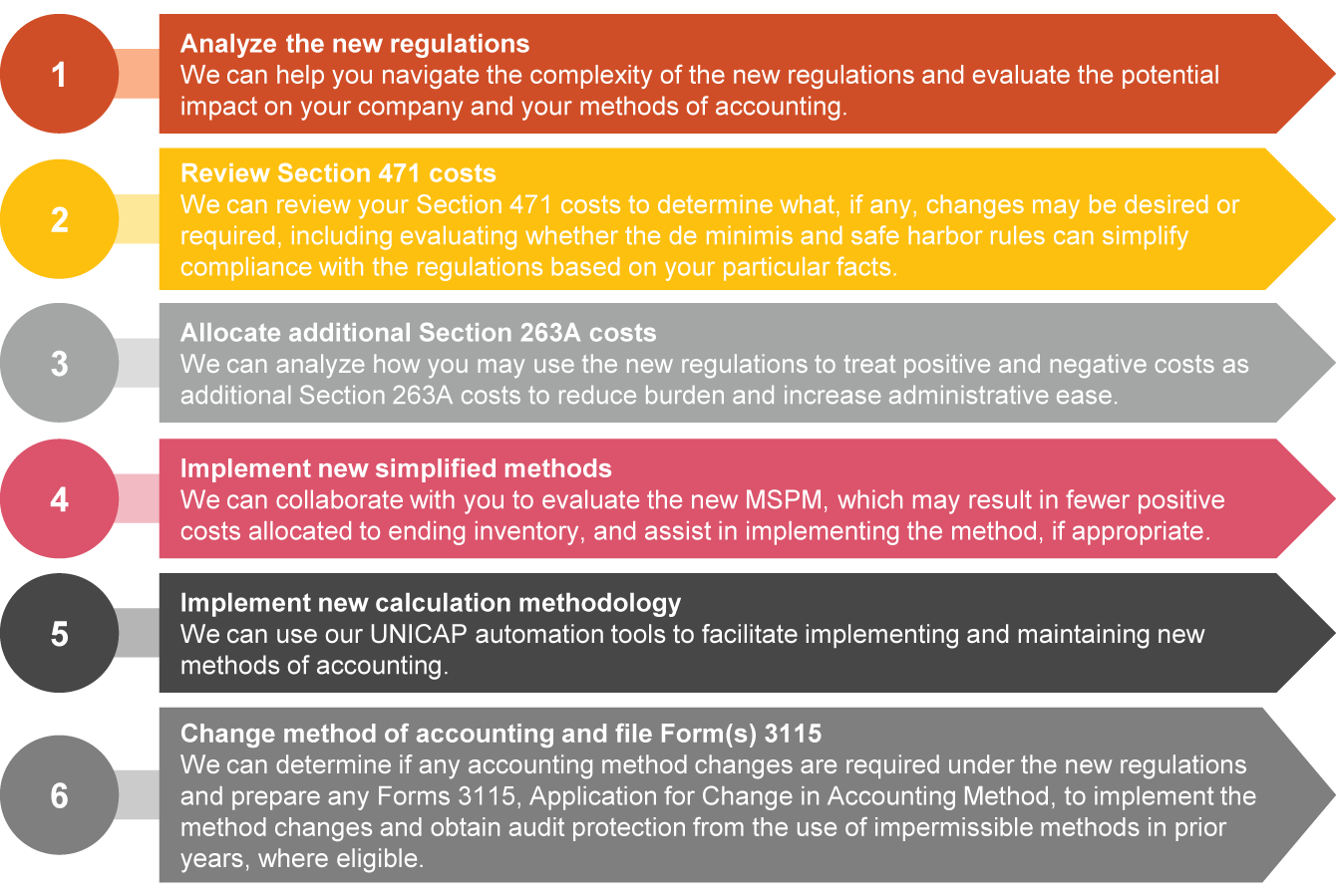

Inventory Solutions Section 263A/ UNICAP PwC

This practice unit outlines the general provisions of sec. Calculating section 263a costs involves determining and categorizing direct, indirect, and mixed service costs, followed by. Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce. The additional section 263a costs attach schedule is used to itemize some of the costs associated.

This Practice Unit Outlines The General Provisions Of Sec.

This practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under irc 263a. Under irc 263a, taxpayers must capitalize direct costs and an allocable share of indirect costs to property they produce. The practice unit provides tax law and audit steps for reviewing a reseller’s uniform capitalization cost computations under section 263a. The additional section 263a costs attach schedule is used to itemize some of the costs associated with purchasing items to either.

Calculating Section 263A Costs Involves Determining And Categorizing Direct, Indirect, And Mixed Service Costs, Followed By.

263a, including special rules and exceptions for resellers, and provides insight into.